Navigation: Sales Tax > Quebec SRM >

Quebec Sales Tax

|

Navigation: Sales Tax > Quebec SRM > Quebec Sales Tax |

|

In Quebec the Provincial rate is nominally 8.5%, but is also applied to federal 5% GST so that the effective provincial rate is 8.925%. Amigo Pos must be set to calculate the QST with the GST included as follows:

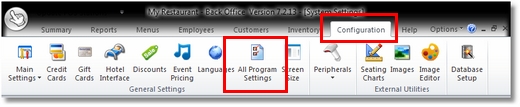

Back Office > Configuration > All Program Settings

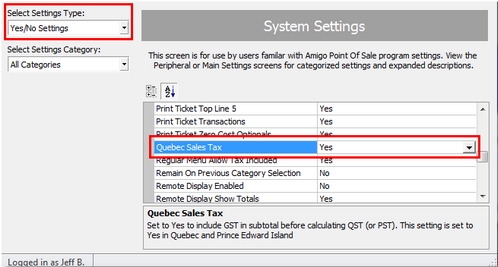

In Back Office > Configuration > All Program Settings, select Yes/No Settings from the drop down list on the right and scroll the settings list until Quebec Sales Tax is visible. Set the value to Yes and press the Update Pos Stations button (so that a program restart is not required).

Enable Quebec Sales Tax

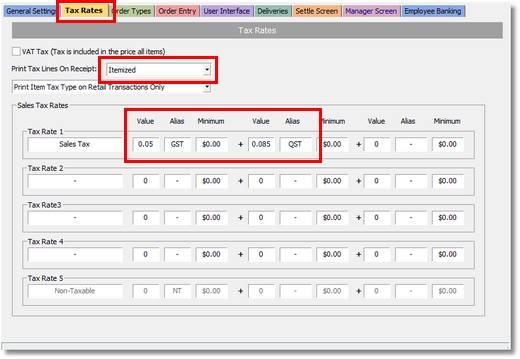

In Back Office > Configuration > Main Settings > Sales Tax, set the tax rate as shown below, so that the GST is calculated before the QST and press the Update Pos Stations button (so that a program restart is not required). Note that the effective sales tax rate is now 13.925% when the Quebec Sales Tax setting is set to Yes above. Set the Print Tax Lines On Receipt setting to Itemized so that the QST is printed below the GST on the customer receipt.

Quebec Sales Tax Rate Settings

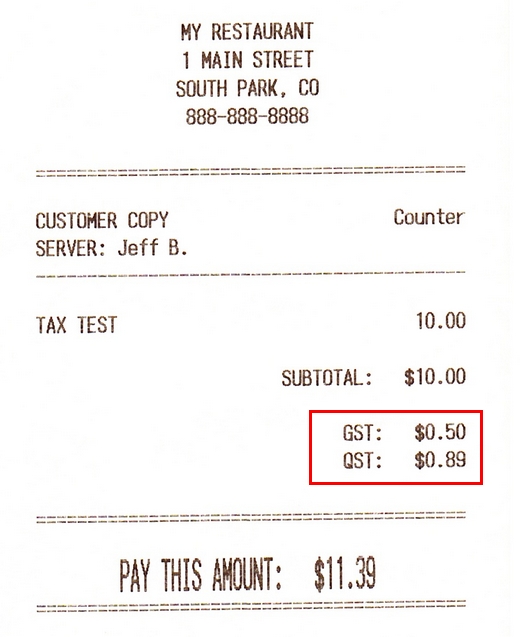

Customer Receipt Itemized Sales Tax

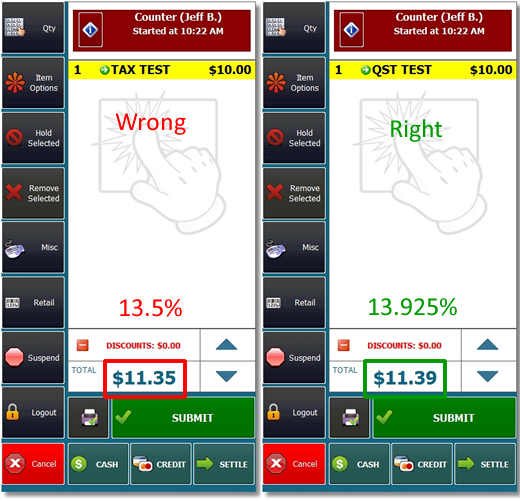

Test the setting in the pos to confirm that the correct sales tax is calculated.

Quebec Sales Tax Test

Page url: http://www.amigopos.com/help/html/index.html?quebec_sales_tax.htm