Navigation: Employees >

Labor Cost

|

Navigation: Employees > Labor Cost |

|

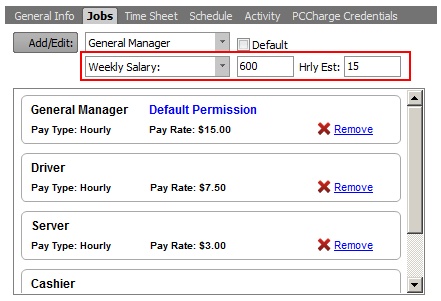

Amigo Pos can estimate the labor cost based on the employee's hourly pay, the number of hours worked and whether to use overtimes rates. Each employee's job determines the labor rate and is set in the employee editor under the Jobs tab. Select the job from the drop-down list and specify whether the job is paid hourly or salaried. The labor cost shown on reports and other screens is always calculated based on an hourly rate. For salaried employees, enter the estimated hourly rate. For example, the General Manager job for the employee below is based on a weekly salary of $600 and the estimated cost per hour is $15.

Employee Editor Jobs Tab

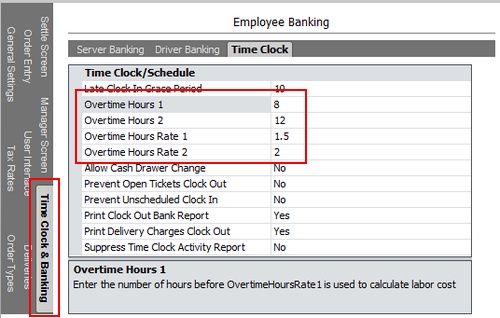

Overtime

Amigo Pos can calculate overtime labor cost as follows:

| • | Overtime Hours 1: Enter the number of hours in a normal shift before the first overtime rate is applied. Overtime calculations can be disabled by entering a high value (i.e. 99) for the Overtime Hours 1 setting so that the regular pay rate is always used in labor cost calculations. |

| • | Overtime Rate 1: Enter the rate to apply for hours exceeding the hours in a normal shift but less than the Overtime Hours 2 value |

| • | Overtime Hours 2: Enter the number of hours in a shift before the second overtime rate is applied |

| • | Overtime Rate 2: Enter the rate to apply for hours exceeding the Overtime Hours 2 value |

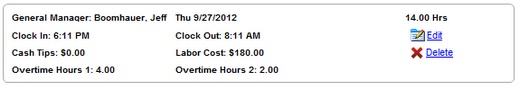

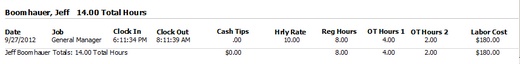

For example, if an hourly employee works a 14 hour shift based on a regular hourly pay of $10/hour with the overtime rates shown above, the labor cost is calculated as shown below and is available on the time sheet editor and employee hours full size report.

|

||

Regular Pay |

8 hrs@$10/hour |

$80.00 |

Overtime 1 Pay |

4 hrs@$10/hour * 1.5 |

$60.00 |

Overtime 2 Pay |

2 hrs@$10/hour * 2 |

$40.00 |

Total: |

$180.00 |

Time Sheet Editor

Employee Hours Report

Page url: http://www.amigopos.com/help/html/index.html?labor_cost.htm